Ytd payroll calculator

The procedure is straightforward. FastFund Online Nonprofit Software.

Year To Date Payroll What Is It

Pay Period End Date cannot be within 90 days of Hire Date.

. Please enter a value for Verified Hire Date. Must be a valid dollar amount. Use the Araize free nonprofit payroll calculator to veryify accuracy.

For example you have four. Michelle earned a total of 40000 in gross income YTD while Ada earned 36000 Mia earned 42000 Chris earned 28000 and Van earned 47000. Get a quick picture of estimated monthly income.

Plug in the amount of money youd like to take home. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide. Total cloud-computing for nonprofit accounting fundraising and payroll.

Pay Type Hours Prior YTD CP. Ytd net pay calculator Jumat 02 September 2022 Take those. The YTD amount is a calculation that helps finance accounting and management professionals determine the evolution of various relevant metrics from the start of the fiscal or.

For example if an employee receives 500 in. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA.

Year-to-date payroll calculator To easily calculate your companys year-to-date payroll gather each employees pay stub and calculate the year-to-date gross incomes. Simple Payroll Calculator Paycheck Manager Small Business Low-Priced Payroll Service 3 Months Free Trial Starting as Low as 6Month Start Free Trial Simple Paycheck Calculator. Period must be between 1 and 26.

Year to Date Income. Free for personal use. Please enter a value for Pay Period.

Please use the Base Pay Calculator for pay periods ending on or before 315. This online calculator is excellent for pre-qualifying for a mortgage. Year-to-Date YTD is referring to the period which begins from the first day of the current calendar or fiscal year aka financial year up to the current date.

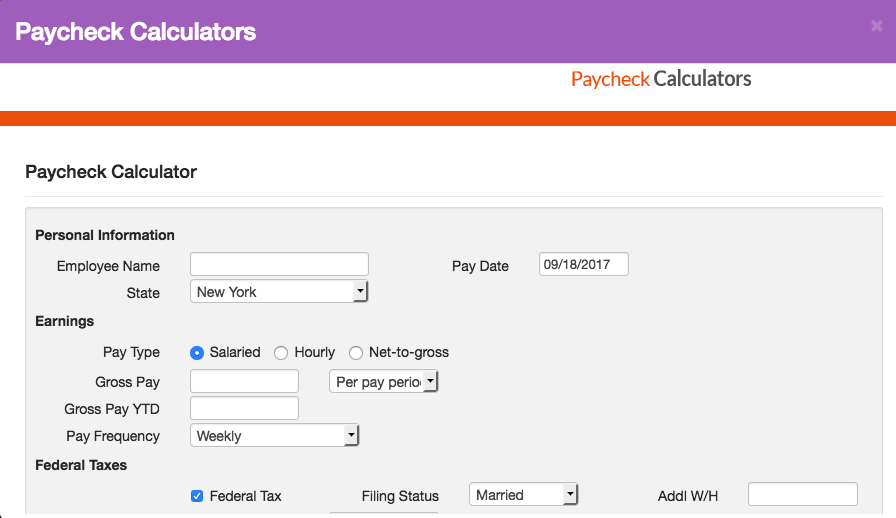

Paycheck Calculator Employee Name Pay Date State Earnings Pay Type Salaried Hourly Net-to-gross Gross Pay Gross Pay YTD Pay Frequency Federal Taxes Use 2020 W4 Federal Tax Filing. Add up all five year-to-date. Please enter a value for YTD Gross Pay.

Enter the year-to-date income in the YTD box then choose the start and finish. Paycheck Calculator Employee Name Pay Date State Earnings Pay Type Salaried Hourly Net-to-gross Gross Pay Gross Pay YTD Pay Frequency Federal Taxes Use 2020 W4 Federal Tax Filing. Computes federal and state tax withholding for paychecks Flexible hourly monthly or annual pay rates bonus or other earning items 401k 125 plan county or other special deductions Public.

Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs.

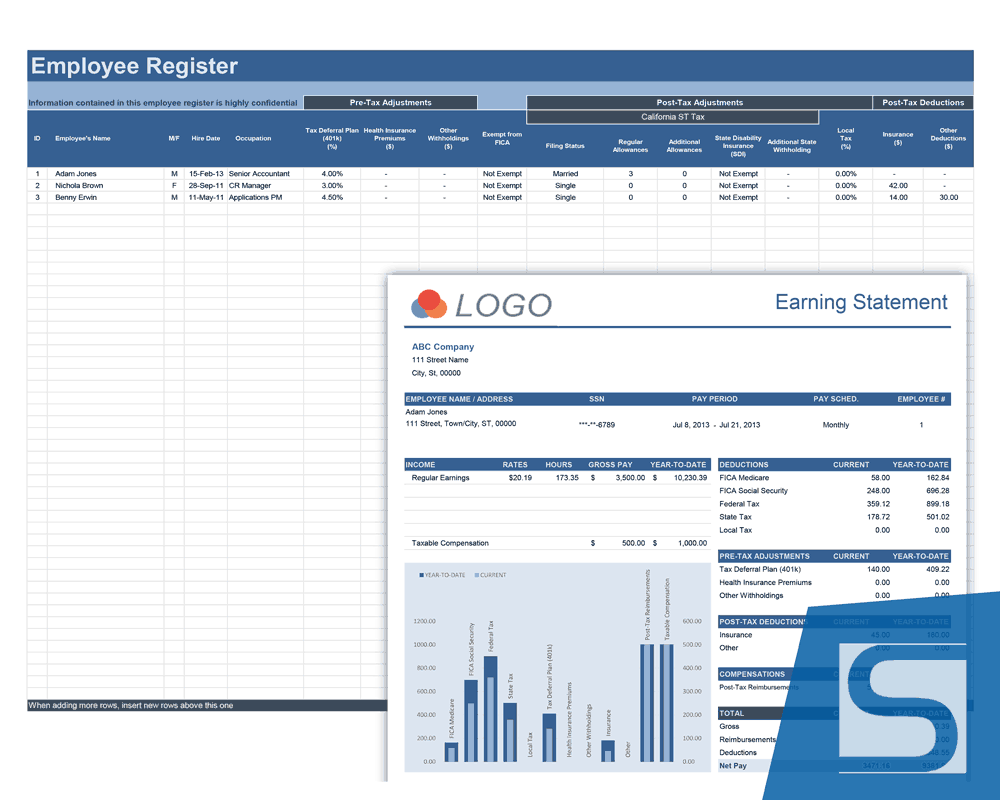

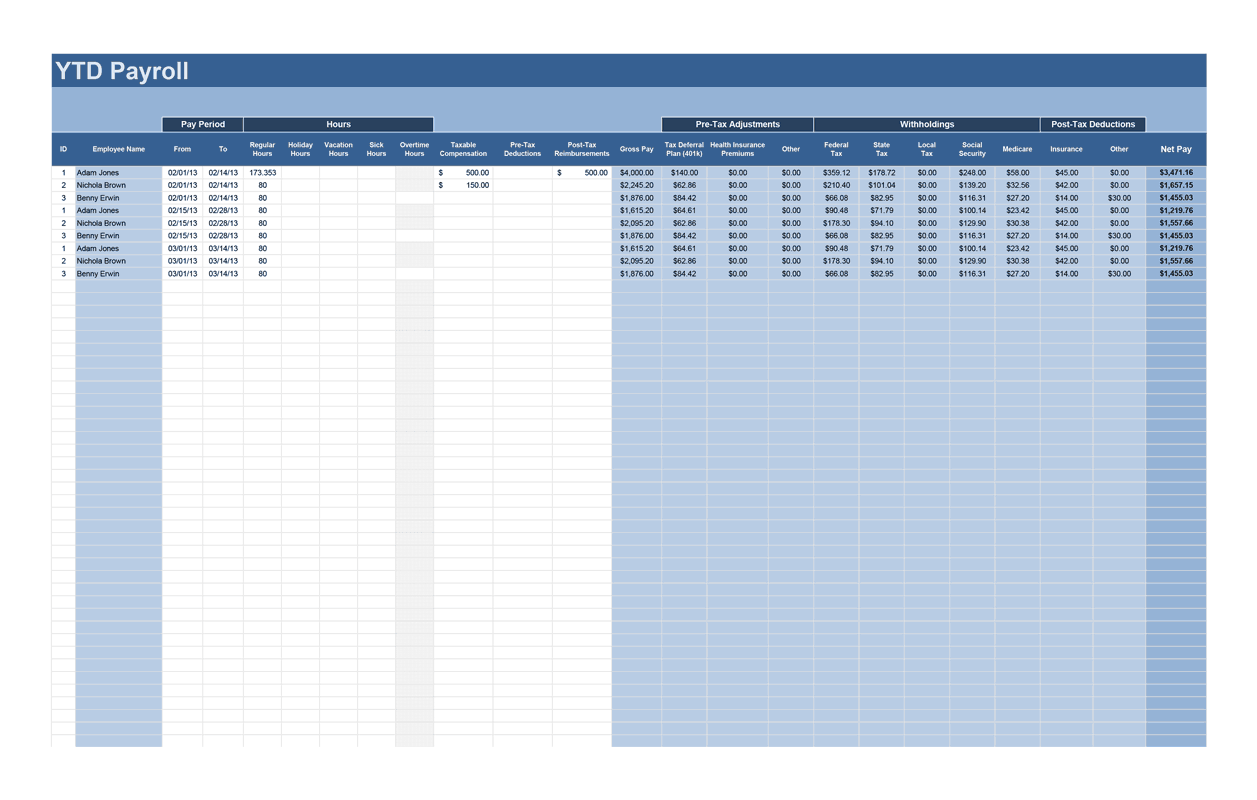

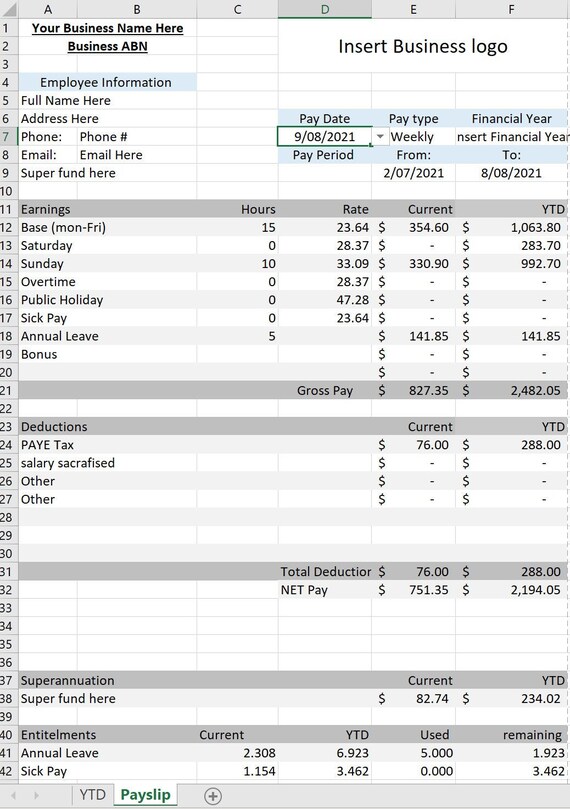

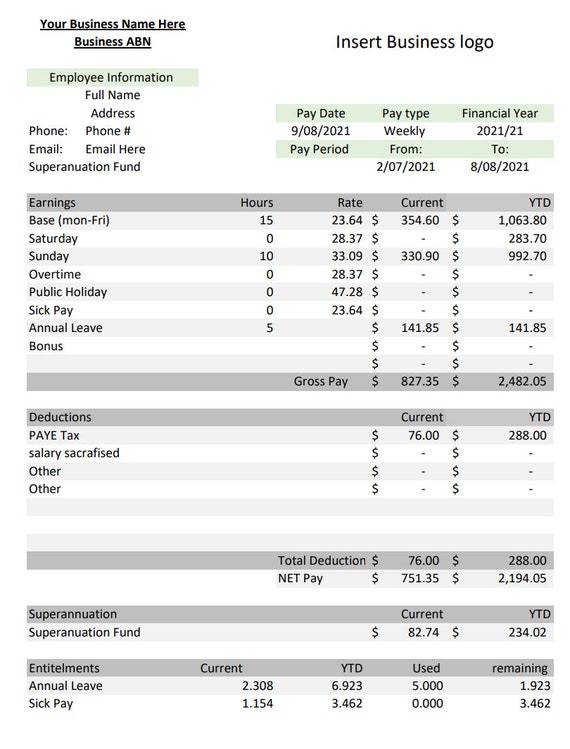

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

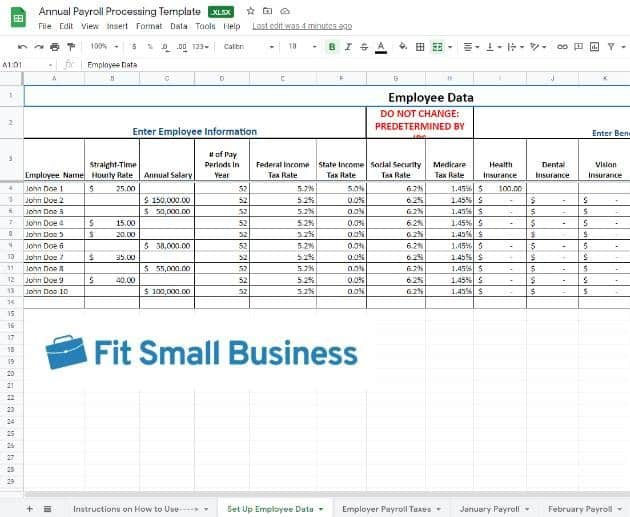

How To Do Payroll In Excel In 7 Steps Free Template

Weekly Pay Slip With Auto Ytd Leave And Tax Calculation Etsy Canada

Weekly Pay Slip With Auto Ytd Leave And Tax Calculation Etsy Canada

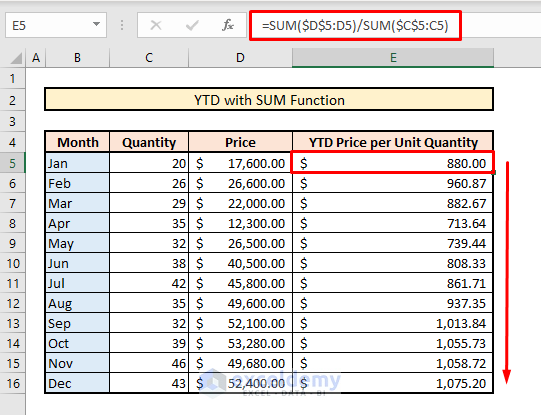

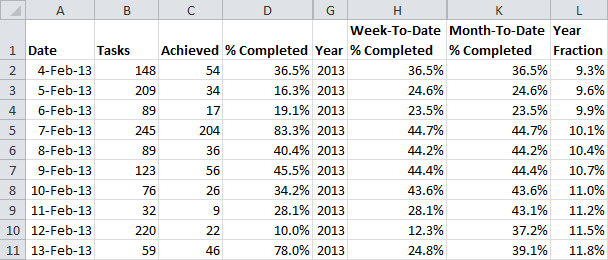

Calculate Month To Date Mtd Quarter To Date Qtd And Year To Date Ytd Using Formulas In Excel Youtube

Ytd Vacation Pay Accrual Report

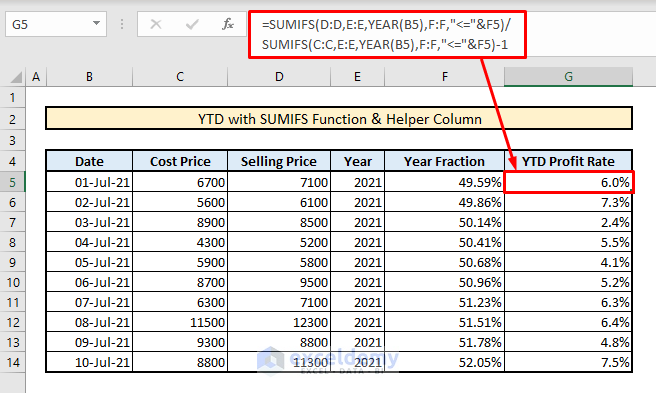

How To Calculate Ytd Year To Date In Excel 8 Simple Ways Exceldemy

Ytd In Payslip Lenvica Hrms

Paycheck Calculator Apo Bookkeeping

Year To Date Ytd Meaning Examples Formula Calculation

Hrpaych Yeartodate Payroll Services Washington State University

How To Calculate Ytd Year To Date In Excel 8 Simple Ways Exceldemy

Week To Date Month To Date And Year To Date Stats Excel Tactics

How To Calculate Year To Date Ytd On Pay Stubs 123paystubs Youtube

How To Calculate Year To Date Ytd On Pay Stubs 123paystubs Youtube